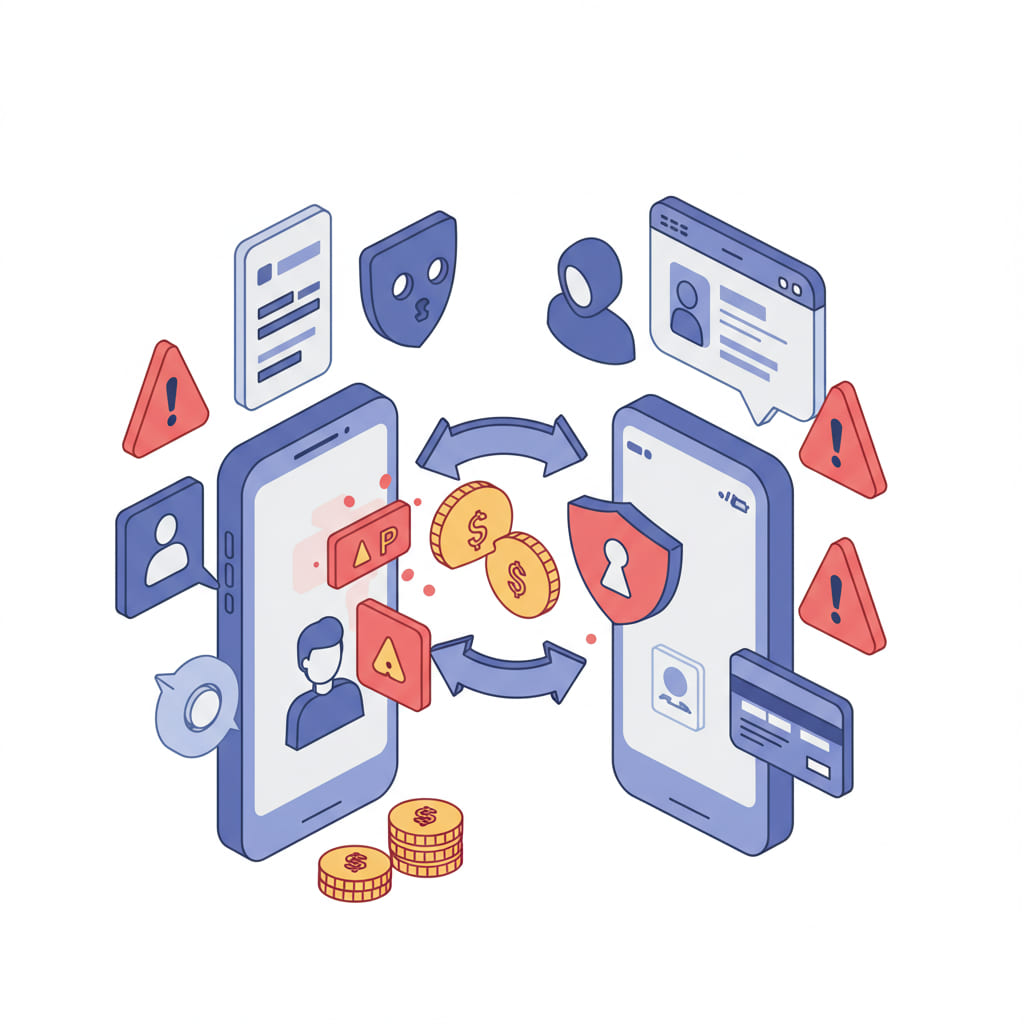

Each transaction is P2P enabling involves sensitive information that you must protect.

Payments between people streamline the exchange of money, but without the right measures, it can become an easy target for fraud and data leakage.

Don't risk the trust of your users

Risks in Payments P2P

⚠ Leakage of sensitive information → Expose financial data of the users may undermine the trust in your platform.

⚠ Fraud and identity theft → No authentication, robust, attackers can perform unauthorized transactions.

⚠ Commitment of payment platforms → A security flaw may allow unauthorized access and economic losses.

How do you Protect your Ecosystem P2P?

🔹 Complying with PCI DSS → Protects payment details and avoid penalties.

🔹 Implementing authentication enhanced → Reduces fraud with multiple factors of verification.

🔹 Monitoring transactions in real-time → Detects suspicious activities before they turn into attacks.

🔹 Ensuring the APIs of payment → Prevents unauthorized access by using controls for cyber security advanced.

17 Years protecting your ecosystem of digital payments

In IQ Information Quality, llevamos más de 17 años ayudando a empresas como la tuya a proteger transacciones en Latinoamérica y el Caribe. Como empresa homologada por el PCI Security Standards Council, te apoyamos en garantizar el cumplimiento de normativas como PCI DSS, PCI PIN para tu ecosistema de pagos P2P.

We invite you to visit our blog, where you'll find topics of interest.

Click here to go to the Blog!

How can we Help you Protect your Platform P2P?

✔ We identify and document the flow of information in your transactions P2P.

✔ We define and validate the scope as security standards PCI.

✔ Implement controls that align with PCI DSS, PCI PIN, PCI 3DS.

✔ We make a diagnosis security and compliance.

✔ We assist in the implementation of the action plan to mitigate risks.

✔ We audit and certify the compliance of the security controls.