What your PIN is insurance?

Have you ever wondered what security measures do you have your entity to protect the PIN from the card users when they pay in a supermarket, in a restaurant or make withdrawals at an atm?

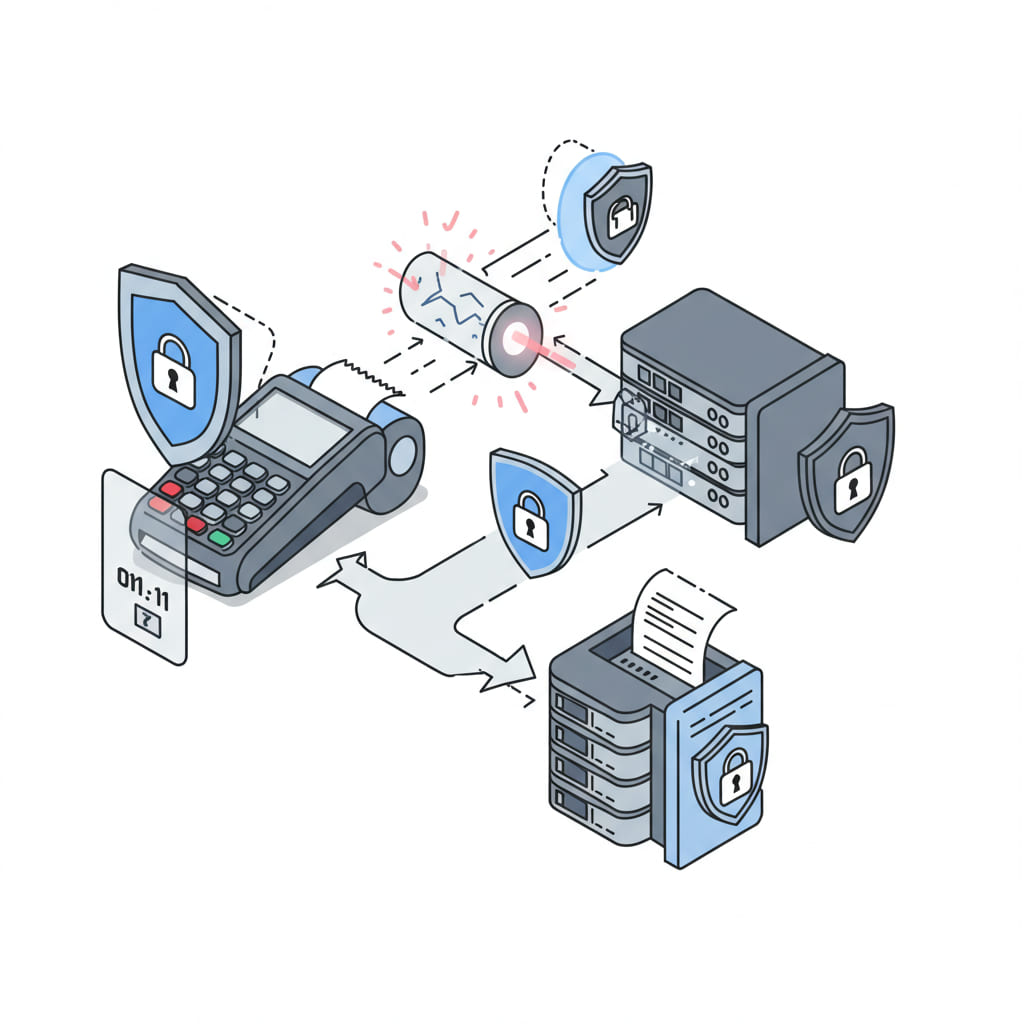

🔹 How is it transmitted the PIN?

🔹 What security measures have been implemented?

🔹 How protected are the authentication data?

Ensures the Integrity of the PIN in All your Transactions

PCI PIN Security Standard) is the global standard that ensures the protection of the Personal Identification Number (PIN) in payment card transactions. To comply with this standard is key to reduce fraud and strengthen the trust in electronic payments.

Strengthens the security of your transactions at atms and POS.

Why Should you Comply with PCI PIN?

The improper use of a PIN compromise the security of payments and expose your organization to risk of financial and reputational. PCI PIN it helps you:

- To ensure the confidentiality and authenticity of PIN throughout the transaction cycle.

- To protect against fraud in automated teller machines (ATMs) and point of sale terminals (POS).

To comply with international regulations and adopt best security practices.

Who Is Covered?

✔️ Acquirers, issuers and payment processors with PIN.

✔️ Companies that operate ATMs, POS, and payment kiosks.

✔️ Providers of encryption, key management and hardware security.

✔️ Organizations that handle sensitive data authentication in payments.

Major Requirements

PCI PIN

🔒 Secure encryption of the PIN: Protects the PIN at each stage of the transaction with robust algorithms.

🛡️ Management of cryptographic keys: Uses Hardware Security Modules (HSM) for generating, storing and distributing keys.

📊 Monitoring and continuous auditing: Evaluates vulnerabilities and prevents unauthorized access.

✅ Controls physical and logical: Strengthens the security of devices, networks and processing environments.

⚙️ Separation of functions: Assigns clear responsibilities to reduce the risk of manipulation.

📑 Registration and traceability: Keep detailed records for audits and accountability.

How can we Help You to Comply with PCI PIN?

1️⃣ Define your Scope: We identify the systems, processes and actors involved in the capture, transmission and processing of the PIN.

2️⃣ We conducted a GAP Analysis: We assess your current state of compliance, detect gaps and to design strategies for improvement.

3️⃣ Implement Controls: We apply technical and organizational measures to reduce risks and ensure compliance with PCI PIN.

4️⃣ We validate and Certify: We performed tests of compliance and issue the necessary documentation for your certification.

Benefits of Complying with

PCI PIN

✔️ Reduces the risk of fraud with security controls are solid.

✔️ Generate confidence in the industry demonstrating conformity with the global standards.

✔️ Protect the reputation of your brand to avoid security incidents.

✔️ Comply with international standards on data protection in payments.