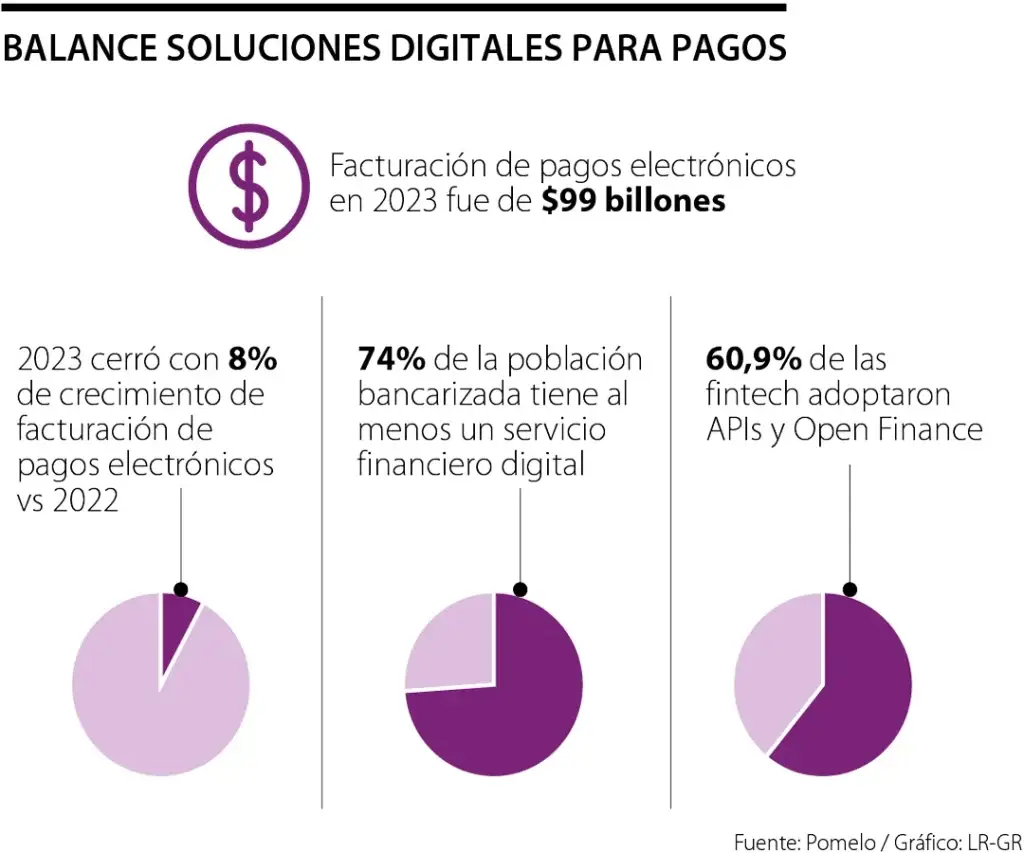

In this transformation, almost 75% of the population bancarizada in Colombia has a financial service digital

The adoption of digital technologies has revolutionized the landscape of financial services in Colombia. According to Credibanco, the billing through the use of electronic payments in 2023 reached $99 billion, registering a remarkable growth of 8%. This reflects how the new mechanisms of digital payment have facilitated transactions for both consumers and merchants and businesses, making them easier and safer.

Growth and Adoption of New Payment Technologies

New technologies have enabled the adoption of methods of digital payment that offer greater convenience and security. The intensification of the use of these means of payment in the past few years is due, in large measure, to the regulation favorable and the benefits that these systems provide, such as instant deposits and payments through smartphones. According to the Fintech Grapefruit, 74% of the population within the financial system used at least one digital service.

Enrique Fadul, Head of Sales of Grapefruit in Colombia and Peru, said: “The Fintech opened a new chapter in the evolution of financial inclusion. Since his arrival in the country, these companies have gained a progressive and sustained adoption on the part of the population, providing ease of use and security guarantees as the main arguments for its inclusion in everyday transactions.”

Innovations and Future Trends

Grapefruit highlights that 60.9% of the Fintech have adopted APIs and Open Finance as their technologies preferred, which opens up new possibilities for users, such as sending remittances. The trends also indicate that the shops will begin to adopt cloud technologies, allowing them to integrate more digital tools. In addition, models such as “pay by bank” or payments, account-to-account (A2A) are gaining popularity, offering greater security assurances to allow online purchases to be paid directly from the bank account without the need to provide credit card data.

Fadul added: “migration processes and technological upgrading today are much more simple thanks to the flexibility and modularity that the infrastructure in the cloud provides. In that order, allow you to start testing progressively partial solutions to the one who consumes, adding much value to the experience of their end users.”

Impact of Digitalization in the Financial Sector

Digitization has not only improved the efficiency of financial transactions, but has also democratized the access to financial services. People who previously had no access to the traditional banking system can now use the digital services to manage your finances, make payments and receive remittances. This has significantly contributed to financial inclusion, reducing barriers, and facilitating the participation of more people in the formal economy.

Challenges and Opportunities in Digital Banking

Despite the advances, the transition to a digital economy presents challenges. Cyber security is a constant concern, as cyber threats evolve along with the technologies. The financial institutions must invest in robust security systems and the education of its users in order to prevent fraud and protect sensitive information. However, these challenges also represent opportunities for Fintech and other players in the market, they can offer innovative solutions to improve the security and user experience in digital banking.

The digital transformation in the colombian financial sector not only is promoting the inclusion and accessibility, but also improving the safety and efficiency of daily transactions. With a combination of technological innovation, appropriate regulation and consumer education, you can consolidate a financial future more connected and safe for all colombians. The financial institutions and Fintech must work together to overcome the challenges and seize the opportunities, ensuring that the benefits of digitization are extended to all corners of society.

Tomado de: https://qrcd.org/5tzD