Each instant payment is an opportunity and a risk.

The speed can not compromise security. Without appropriate measures, cyber-attacks, fraud and manipulation of data can affect the integrity of the transactions and the confidence of your customers.

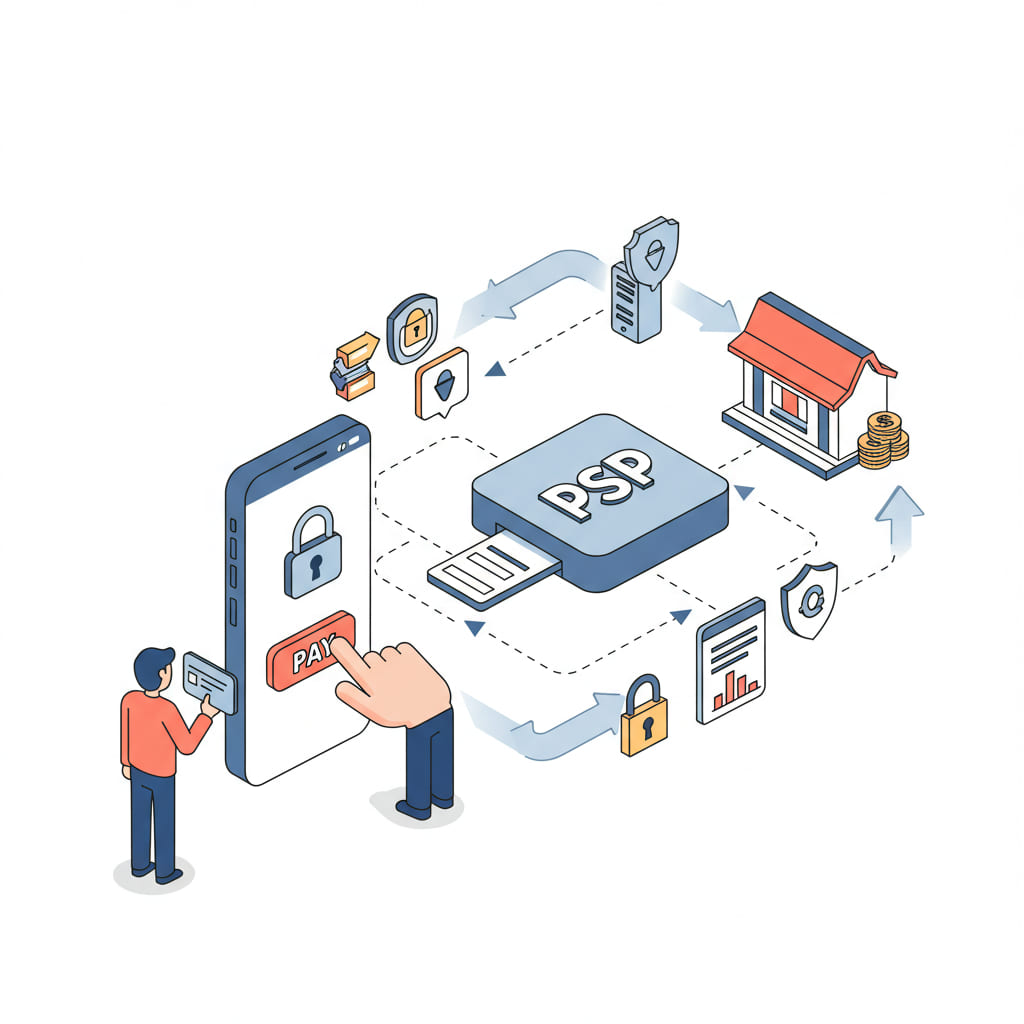

The Ecosystem of the Instant Payments

The real-time payments depend on the interaction of multiple actors:

🔹 Payment Services providers (PSP): Banks, fintechs and financial institutions that process transactions.

🔹 Schemes of Instant Payments: Infrastructure that interconnects PSPs, such as PIX (Brazil), SPEI (Mexico) or RTP (Uk).

🔹 Clearinghouses: Entities that settle payments between PSPs, as an IPC (Colombia) and CANAPE (Mexico).

🔹 Central banks and Regulators: Oversee and set standards to ensure stability and safety.

🔹 Businesses and Consumers: Companies offer payments agile and customers are used to send and receive money.

Converts each payment in a safe and secure transaction

How does a transaction, instant payment?

1️⃣ The user initiates the payment through a PSP.

2️⃣ The PSP sends the request to the schema of instant payments.

3️⃣ The transaction is validated and processed in seconds.

4️⃣ The clearing house settles the funds between the PSPs.

5️⃣ The recipient receives the money right away.

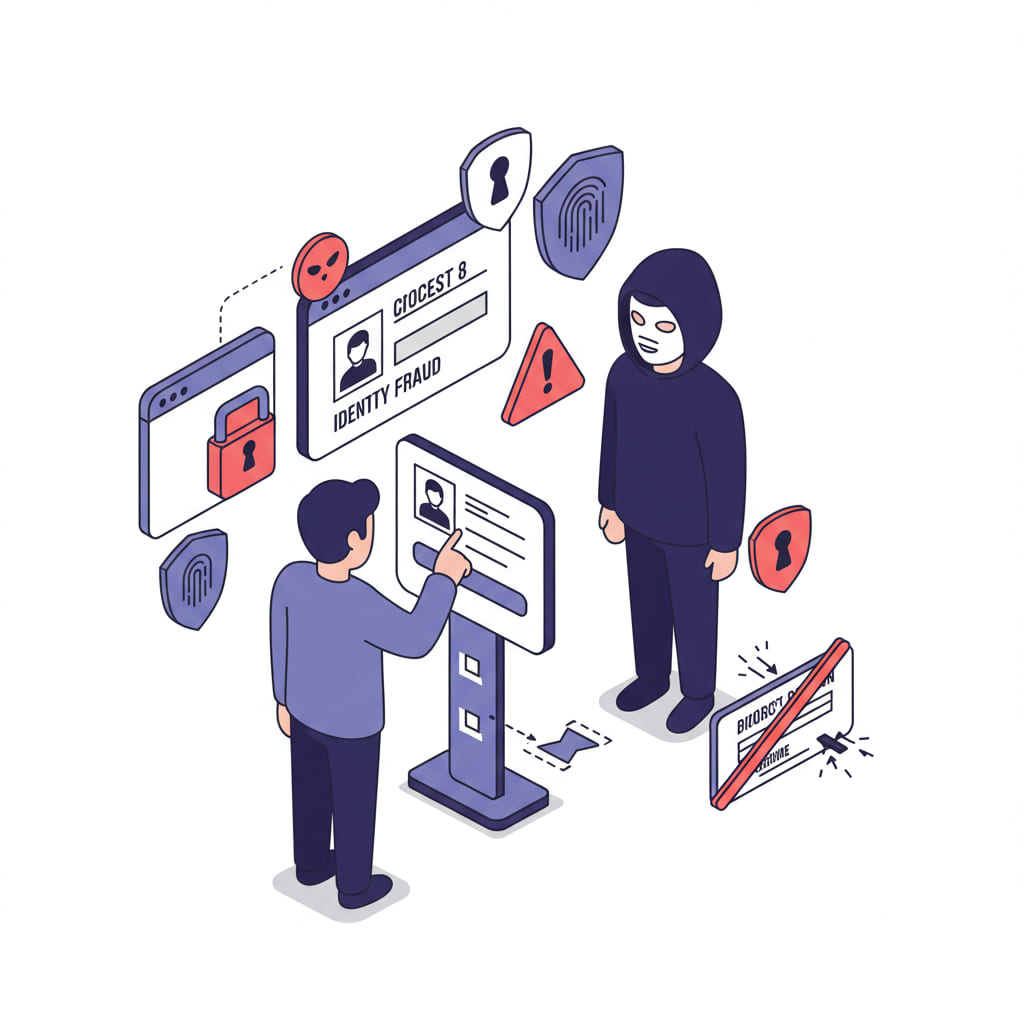

Risks in the Instant Payments

⚠ Fraud and identity theft → No authentication, robust, attackers can execute unauthorized transactions.

⚠ Attacks of intermediary (Man-in-the-Middle) → The alteration of data in transit can modify the amounts or beneficiaries.

⚠ Commitment of APIs and payment services → A failure in the infrastructure can expose confidential information.

⚠ Leak of financial data sensitive → No encryption and adequate monitoring, the information of the users is vulnerable.

Compliance: the Key to the Safety

The speed of payments may not go to the detriment of safety. Comply with international standards is essential to protect financial data and avoid security breaches.

✅ ISMS ISO 27001: Protects the information at the organizational level.

✅ PCI DSS: Set controls for the security of payment data.

✅ PCI PIN: Ensures the authentication of electronic transactions.

17 Years Protecting the Security of Digital Payments

In IQ Information Qualitywe have over 17 years of experience protecting ecosystems of payment in Latin america and the Caribbean. As a company approved by the PCI Security Standards Council, help you to comply with security regulations and to implement effective strategies to mitigate risks.

How Do You We Support?

✔ We identify the information flows and their risk exposure.

✔ We define and validate the scope of security of your infrastructure.

✔ We apply controls to protect transactions in real-time.

✔ We perform diagnostics and audits of compliance.

✔ We accompany the implementation of corrective measures.

✔ We provide specialist advice on regulations and best practices.